Plan and invest with ClearFuture

Financial Planning for Small Businesses

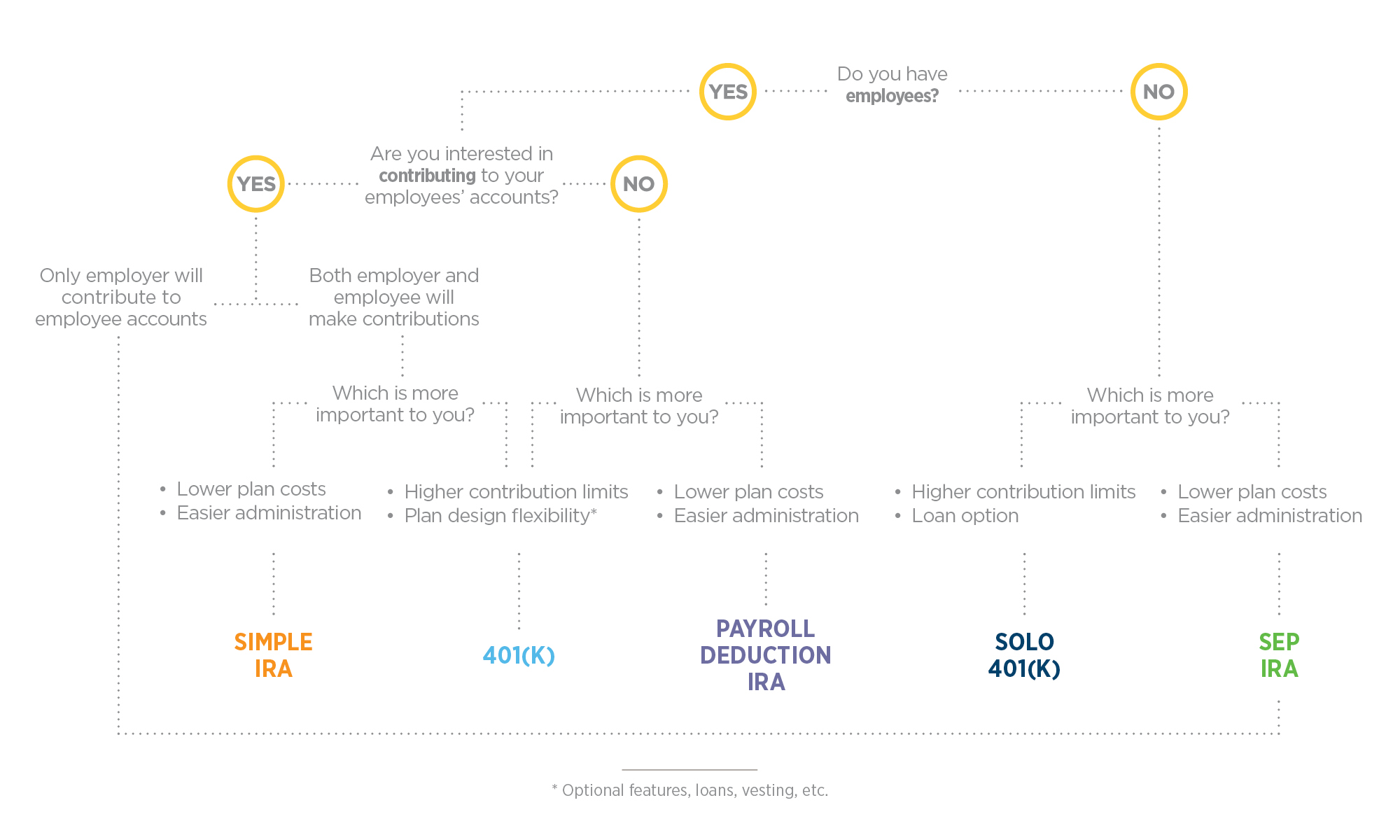

Want to offer a retirement plan for your employees but just don’t know where to begin? We can help take the guesswork out of selecting the right plan. You’ll feel confident knowing you are making the right choice for your employees and their future. Let us help find the right plan for you!

401(k) Plans

Do you have more than 20 employees?

Offering a 401(k) can help a business attract and retain top talent in a highly competitive job market. You have a lot of control and flexibility over what your business contributes, who is eligible to participate, and when participation begins. Both you and your employees can enjoy the tax benefits of a 401(k) plan.

KEY ADVANTAGES

- Contributions and earnings are not taxed until distributed

- Employer has control over eligibility and contribution flexibility

ELIGIBLE EMPLOYER

- Any non-government employer

WHO CONTRIBUTES?

- Employee

- Employer (Match or optional contribution)

VESTING

- Employee contribution is 100% vested immediately. Employer contribution may be subject to plan vesting schedule.

SOLO 401(k) Plans

Do you own your own business but have no employees other than yourself?

You might consider a Solo 401(k)—also known as a One Participant 401(k). This plan is designed for employers and their spouses and have the same rules and requirements as any other 401(k) plan. Contributions can be made both as the employer and the employee.

KEY ADVANTAGES

- Save more for retirement, even with a low salary

- Get both an employee salary deferral AND an employer profit-sharing contribution

- Flexible

ELIGIBLE EMPLOYER

- Sole owner with no employees

WHO CONTRIBUTES?

- Self-employed individual with no employees

VESTING

- 100% vested immediately

Simple IRA Plans

Do you have 100 or fewer employees who earned $5,000 or more during the preceding calendar year?

If you want something a little less complicated than a 401(k), consider a Simple IRA plan for your workforce. Your company’s contributions are a tax-deductible business expense, and your employees can make pre-tax contributions with tax-deferred growth potential.

KEY ADVANTAGES

- Reduces employee taxes

- Easy and inexpensive to set up and maintain

- No annual filing requirement

ELIGIBLE EMPLOYER

- Employers with 1-100 employees who earned $5,000 or more during the preceding calendar year

WHO CONTRIBUTES?

- Employee

- Employer (Matching or 2% of compensation)

VESTING

- 100% vested immediately

SEP IRA Plans

What’s the difference between a Simple IRA and a SEP IRA?

For one thing, with a SEP IRA, only the employer makes contributions. If you’re self-employed, a sole proprietor, a business owner, or in a partnership, this might be the right choice for you. Your contribution can vary from year to year (0% to 25% of compensation), but the percentage must be the same for every employee.

KEY ADVANTAGES

- Easy and inexpensive to set up and maintain. Generally, no annual filing requirement.

- Business pays no taxes on investment earnings

- Employer has flexibility in annual contributions

ELIGIBLE EMPLOYER

- Any employer

WHO CONTRIBUTES?

- Employee

VESTING

- 100% vested immediately

Note: Electronic mail (email) is not secure. Any confidential or sensitive personal/business information should not be communicated in this manner.

Investments through CFS*

* Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The credit union has contracted with CFS to make non-deposit investment products and services available to credit union members. ClearFuture Financial is a trade name for the investment & insurance products available at 3Rivers Federal Credit Union

CUSO Financial Services, L.P. and its representatives do not provide tax or legal advice. For such guidance, please consult your tax or legal professional.